Masters in Accounting in Ireland | 7 Best Courses in 2024

If you’re considering pursuing a Masters in Accounting in Ireland would be your perfect destination.

Ireland is a beautiful country with a rich cultural heritage and home to some of the world’s top universities offering accounting programs.

Accounting is no longer for people who can analyze, summarize, and record monetary assets. With technology, the accounting-related profession has gone way beyond what one can imagine.

The Modern Accountancy courses allow you to leverage the power of digital tools to shift finance functions from cost-saving centres to profit generators. These are exactly the course characteristics of an Accounting master in Ireland.

This blog will explore the various Masters in Accounting programs available in Ireland, the admission requirements, career prospects, and much more.

So, whether you’re a recent graduate or a seasoned professional looking to advance your career, join us on this exciting journey of discovering Masters in Accounting in Ireland!

Why Should You Study Masters in Accounting in Ireland?

Increased job market: Masters in accounting are highly regarded by accounting firms in Ireland, including the Big 4 (Deloitte, Ernst & Young, KPMG, and PwC).

Quality training: MSc Accounting and Finance courses in Ireland are taught by leading academics, researchers, and industry practitioners.

Skill shortage likely to worsen in 2024: With a fall in accounting masters graduates following the 2008 recession, Irish firms struggle to access the necessary talent. Accountants with high skills are needed to fill the job openings in accountancy that grew by 28% in the last quarter of 2022. [Source: IrishExaminer]

Critical skill visa: You can apply for a PR in Ireland within 2 years of employment if you can secure a job among the critical skills occupation list. The good news is accountant jobs are one on this list.

Recognition of ICAI Qualification: Ireland is one of seven countries recognizing the ICAI (The Institute of Chartered Accountants of India) Qualification.

High average salary: The average base salary for Masters in Accounting in Ireland is €51k/ year.

Who Can Study Masters in Accounting in Ireland?

- Students with a bachelor’s degree in accounting (like BBA or B.Com) and a firm understanding of business and accounting principles.

- Non-accounting graduates with high grades in accounting or finance-related modules in their bachelorette degrees.

- Students should be exempted from their CAP1 or equivalent accounting professional body examination.

Masters in Accounting in Ireland: Top Universities

These are the top universities for Masters in Accounting in Ireland:

| Global Rank | Accounting Masters University in Ireland |

| #74 | Trinity College Dublin |

| #101-150 | University College Dublin |

| #201-250 | Dublin City University |

| #251-300 | University of Galway |

| #251-300 | University College Cork |

Please note: Trinity College Dublin has only Postgraduate Diploma in Accounting.

7 Best Courses for Masters in Accounting in Ireland:

There are the seven best courses for Accounting Masters in Ireland,

- Masters in Accounting (MAcc)

- Master of Science in Accounting (MSc)

- Master of Business Studies in Accounting (MBS)

- MSc. Accounting & Finance

- MSc. International Accounting & Analytics

- MSc. Management Information & Managerial Accounting Systems

- MA in Accounting

Read more: Top 10 Masters Courses in Ireland

Accounting and Finance Courses in Ireland:

1. University College Dublin:

-

MA. Accounting (MAcc):

Curriculum: Modules at UCD doesn’t stop your boundaries within theories and concept with Accounting. Rather it goes further to develop an array of technical skills in the areas fundamental to the accounting profession. To prepare yourself more competitive among peers in professional examinations, your knowledge is honed through case studies, whilst IT is used extensively throughout.

Benefits of the course: MSc Accounting course from UCD has a high reputation in the eyes of recruiters. The course provides full hands-on experience with the IT tools needed to adapt to the contemporary accounting profession. Your employer likes you more if you can alleviate the cyber risks businesses face today. And these are all the qualities you would possess upon graduating from this course.

| Did you know?

Students of Masters in Accounting from UCD are employed within 6 months after graduation. |

-

MSc Accounting & Financial Management:

Curriculum: The MSc Accounting & Financial Management course at UCD balances theoretical learning and applied skills development. This is the only one and the best master’s in accounting and finance program in Ireland.

You also learn to analyze business strategy, IFRS accounting standards, advanced financial reporting and consolidation, risk management systems, performance measurement and management, and strategic corporate finance and management control systems.

Benefits of the course: Improves your accounting and financial management skills with a solid grasp of measurement and management techniques. Graduates from the program start their CIMA examinations at the Strategic Case Study level and are entitled to seven exemptions from ACCA, including Financial Management (FM), Financial Reporting (FR), and Performance Management (PM).

2. University of Galway:

-

MSc. International Accounting & Analytics

This program at J.E. Cairnes School of Business & Economics, University of Galway, has two pathways:

Pathway A: For General Business related/Commerce graduates who now wish to specialize in Accounting & Analytics. (September Intake)

Pathway B: For Early – Mid Career Accountants. Most ideal for candidates who are already a member of professional accounting bodies. (January Intake)

Curriculum: The entire course is designed to include practical courses on data interrogation and analytics to provide accountants with the analytical skills necessary to succeed in the workplace. Graduates become accounting and business analytics experts through taught modules, our practitioner-led Summer School – ACCA Accelerate program, and KPMG-led Summer School.

Benefits of Pathway A: Graduates of this course will be exempted from 7 papers of ACCA and CPA examinations.

Benefits of Pathway B: Graduates who already hold an associate membership of the recognized professional accountancy bodies in Ireland or from their country have an exemption from 50% (45 credits) of the 90 credits for this taught master’s course.

-

MA. Accounting (MAcc):

Curriculum: The entire course modules are designed concerning the Chartered Accountants Ireland (CAI) syllabus. The main intention of this program is to give its participants a rich understanding of the use of software, analytical skills, and cognitive technologies to analyse audit and accounting data.

Benefits of the course: Graduates of this course consistently achieve very high places in the final examinations of Chartered Accounts. Participants also grab the chance to attend the KPMG-led Analytics Summer School entitled “Audit and Accounting in the 21st Century: Data & Analytics, Artificial Intelligence, and Related Technological Tools”. Along with this, you get a full exemption from CAI’s CAP2 examinations.

3. Dublin City University:

| Did you know?

DCU Business School has the reputation of being Ireland’s most Innovative B-school |

-

MSc. Accounting:

Curriculum: A Forbes report claims that accounting embraces change constantly, so Accounting education should follow suit. MSc Accounting at DCU is designed and constantly updated with leading industry and academic experts. Each module in the course prepares the students to work and practice with advanced accounting knowledge by applying contemporary strategies, behavioural science, and organization theories. Special emphasis is placed on long-term managerial policies and the relevance of corporate finance to the accountant.

Benefits of the course: Graduates gain generous exemptions in professional body examinations and can succeed in the advanced professional examinations in accounting, such as the FAEs. Additionally, you should know that Accenture, Deloitte, EY, Grant Thornton, JP Morgan, KPMG, and PwC are common recruiters for Accounting at DCU.

-

MSc. International Accounting and Business:

Curriculum: This course largely concentrates on addressing the need for the complex commercial environment. The curriculum helps the students provide professional solutions based on a comprehensive understanding of accounting and business relationships.

Benefits of the course: Besides exempting advanced professional accounting examinations, this course allows you to learn the subject that incorporates both professional and applied business material and an analytics component.

4. University College Cork:

-

MA. Accounting (MAcc):

Curriculum: Modules of MAcc at University College Cork are designed with significant contributions from partners, directors, and training managers in major accounting firms. This course is for students who want to see themselves as a strong trainee accountant in major accounting firms, financial institutions, and leading industrial companies. Modules cover the core technical materials that expose the emerging contemporary issues in accounting and finance. In addition, personal competencies and skills in commercial judgment are also developed.

Benefits of the course: MAcc graduates are exempt from all papers in part 1 of the AITI Chartered Tax Adviser (CTA) qualification. In addition, they also gain full exemption from all but the Final Admitting Examination (FAE) of Chartered Accountants Ireland (CAI).

-

MSc. Management Information & Managerial Accounting Systems:

| Did you know?

This is the only Master’s course in Ireland to focus on both Accounting and Information Systems |

Curriculum: MIMAS at Cork University Business School is a challenging postgraduate degree that includes a three-month industrial internship and covers a variety of modules in the subject areas of Accounting and Information Systems. Ultimately, you will gain knowledge of management accounting concepts and techniques used in major decision-making, along with how technology can be leveraged to improve operations and transactions.

Benefits of the course: Graduates are enhanced with various skills apart from accounting; this includes historical data analysis to predict future trends and design and build information systems from a process, database, and user interface perspective. On course completion, students grab the opportunity to become business analysts, accountants, auditors, and information systems professionals.

Please note: This course is open to graduates of all disciplines but not for graduates with degrees with high levels of software development and management accounting.

5. Maynooth University:

MA. Accounting:

Curriculum: The modules in this course concentrate on key areas of the current financial environment in which accountants operate. This is done by giving an in-depth knowledge of advanced financial and management accounting skills with practical reference to real-life learning scenarios.

Benefits of the course: Graduates will be exposed to original research on a topic in Accounting or a related field and have an exemption from CAP 2 examinations (CAI) and AA (ACCA).

6. TU Dublin:

MBS. Accounting:

Curriculum: Modules will equip the students with the skills and competencies required to undertake independent research in accounting and related areas.

Benefits of the course: Graduates are successfully trained to gain the competencies required to complete the examinations of the major accounting bodies operating in Ireland.

|

Have You Read Our Top Articles? 💁♀️Why Study Masters in Ireland |

7. Atlantic Technological University (LYIT):

MA. Accounting:

Curriculum: The modules cover a variety of accounting, tax, and finance modules, letting you explore the area you are most interested in moving forward in your career. These are done through teaching advanced theories and practising the same.

Benefits of the course: Work placement for this course is a bonus at ATU with generous exemptions from ACCA, CPA, CAI, ad CIMA.

8. Technological University of Shannon:

MA. Accounting:

Curriculum: The MA Accounting curriculum at TUS(AIT) is updated with a new Accounting Research Project. The entire course concentrates on core accounting subjects that encourage self-directed learning and developing an awareness of the broader accounting discipline.

Benefits of the course: Along with the professional exam exemptions, this course has various other highlights. Some include real-life case studies, accounting research projects, RBK Budget Breakfast Briefing, guest lectures, and mock interviews.

9. Dublin Business School:

MSc. International Accounting & Finance:

Curriculum: It is designed for graduates seeking to gain exposure to data-driven financial decision-making roles. The curriculum has a strong strategic focus on accounting, quantification of data, treasury functions and corporate finance.

Benefits of the course: It helps you gain critical knowledge and practical skills in international accountancy and finance issues in an ever-changing market.

10. National College of Ireland:

MSc. Accounting:

Curriculum: The entire course is designed based on consultation with industry experts for graduates coming from a non-accounting background. This course gives a broader business viewpoint and develops insights into effective leadership practices, corporate governance, and ethics issues.

Benefits of the course: Graduates with a non-accounting background can pursue a professional accounting career much faster with this course.

11. Griffith College Dublin:

MSc. Accounting & Finance Management:

Curriculum: This is designed to advance the students’ functional management competencies in finance and accounting. They can also diversify their business knowledge through electives modules in leadership, digital business, managerial economics, and more.

| Did you know?

MSc. Accounting & Finance Management program at Griffith holds the pride of being the finalist for Excellence in Education from the Irish Accountancy Awards 2020 & 2022 |

Benefits of the course: 9 exemptions from the ACCA foundation papers and 4 from the finals.

Cost for Studying Accounting Masters in Ireland:

The cost of studying Masters in Accounting in Ireland can be anywhere between 10.68 Lakhs to 19.15 Lakhs. Below is a detailed overview of the tuition fee in the respective universities.

| University College Dubin | €21,520 |

| University of Galway | €11,990 – €17,890 |

| Dublin City University | €15,500 – €17,000 |

| University College Cork | €18,900 |

| Maynooth University | €15,000 |

| TU Dublin | €13,500 |

| Atlantic Technological University | €12,000 |

| Technological University of the Shannon | €14,500 |

| Dublin Business School | €13,500 |

| National College of Ireland | €15,000 |

| Griffith College Dublin | €14,000 |

Masters in Accounting Ireland: Requirements

Below furnished details are the overall cumulated requirements for Accounting Masters in Ireland:

- UG Score: All Irish universities expect a minimum score of 6.5, considering a 10-scale grade system. Technological universities and colleges can expect candidates with a minimum score of 6.0, provided they have a good score in their accounting/finance modules.

- Work experience: Some universities consider 2 to 5 years of relevant work experience if the students don’t satisfy their basic UG criteria.

- English language: IELTS 6.5 or equivalent is expected by the universities, and a 6.0 or equivalent is expected in technological universities and colleges.

Scholarships for Masters in Accounting Ireland:

| University College Dubin | Global Excellence Scholarships | 50% or 100% of the tuition fee |

| University of Galway | Business postgraduate merit scholarships | Upto 50% of the tuition fee |

| Dublin City University | Merit scholarships | Upto 25% of the tuition fee |

| University College Cork | SEFS International student merit scholarship | €1,000 upto 20% deduction from the tuition fee |

| Maynooth University | Taught postgraduate scholarships | €2,500 |

| Technological University of the Shannon | Accounting merit scholarships | €1,000 to €3,000 |

| Other Technological Universities & Colleges | International merit scholarships | €1,000 |

Apart from these, you can apply for the Government of Ireland Postgraduate Scholarship, which lets you study for FREE in Ireland and a stipend of €10,000 to cover your living expenditure.

Read more: A Guide to Scholarships in Ireland for International Students

Career Prospects for Accounting in Ireland:

With an increase in skill shortage for accountant jobs in Ireland, there are currently 5000+ LinkedIn openings for graduates with accounting masters in Ireland.

Average base pay:

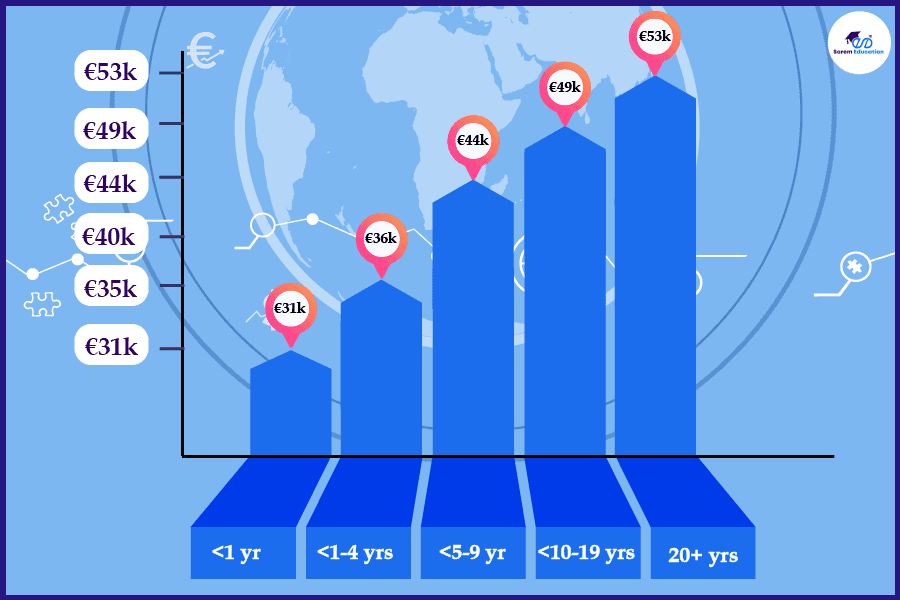

The average base pay for graduates of an Accounting Masters degree in Ireland is €51,000/annum. In Indian amounts, it is 45 Lakhs/annum.

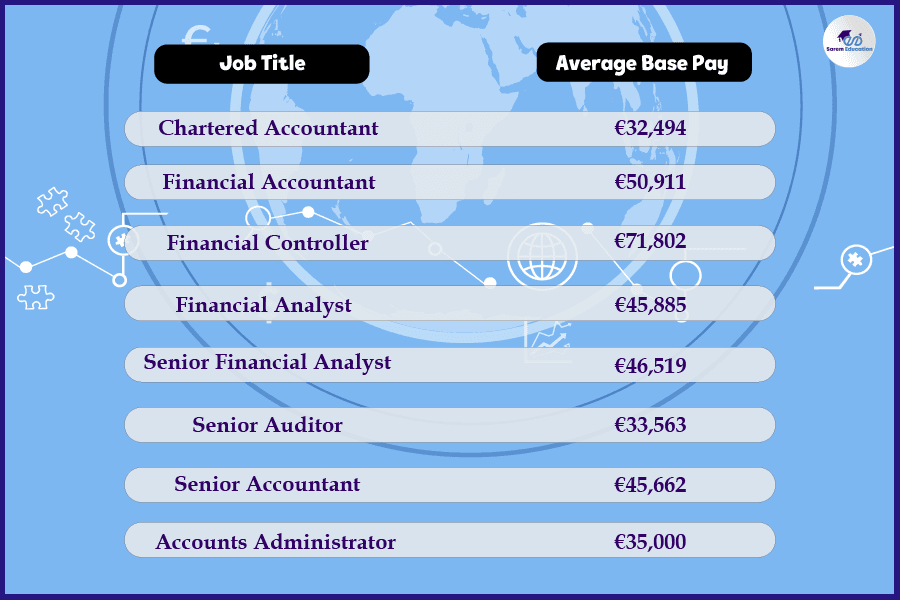

Jobs for Accountants in Ireland:

These are just a few jobs listed on this page. Additionally, Ireland has many other accounting-related positions, such as Accounts Administrator, Accounts team leader, etc., which pay luxuriously.

Are You Ready to Get Paid Luxuriously?

Pursuing a Masters in Accounting in Ireland can be a game-changer for your career.

With Ireland being a hub for top international accounting firms, the opportunities for growth and development are endless.

Another speciality of choosing Ireland as your study destination is access to a diverse network of professionals, professors, and alumni who can provide valuable insights and career opportunities.

With Masters in Accounting in Ireland, you could work in the financial services industry, banking, retail, government, information technology, or even in the music industry, as practically every business requires accountants.

And hope you’d know this by now!!

If you are ready to take the next big step, let us help you.

Want to know the perks our study in Ireland experts can give you? Keep a watch below.

Our Study Abroad Experts are Online

Get in touch with our experts for free admission guidance.

Comments are closed.